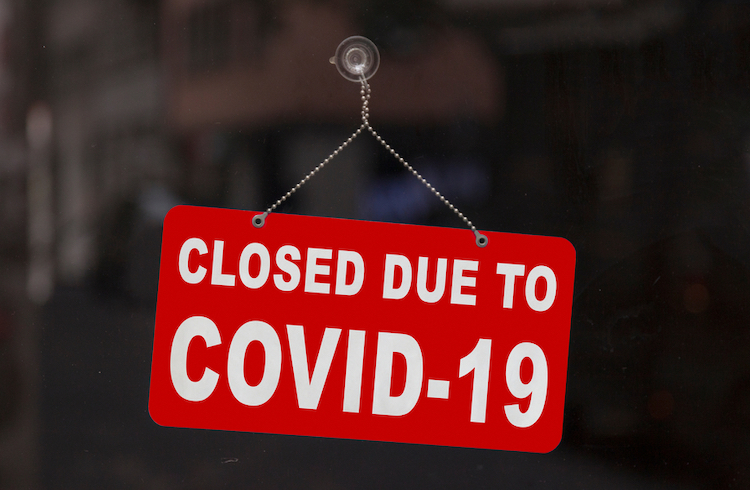

6th Circuit rules against restaurant seeking insurance coverage for losses after shutdown order

Image from Shutterstock.

A shutdown order that barred in-person dining was not a direct physical loss or damage to property covered by a "business interruption" insurance policy, a federal appeals court has ruled.

The Sept. 22 ruling by the 6th U.S. Circuit Court of Appeals at Cincinnati is in line with other recent appeals court decisions involving business losses from the COVID-19 pandemic, Law.com reports.

The 6th Circuit ruled against Santo’s Italian Cafe, the corporate parent of the Italian restaurant Santosuossos in Medina, Ohio. The restaurant had sued the Acuity Insurance Co. for coverage under a policy provision covering loss of income that is “caused by direct physical loss of or damage to property.”

The 6th Circuit said the loss of income isn’t covered because the restaurant wasn’t “tangibly destroyed,” and the owner “has not been tangibly or concretely deprived of any of it.”

Santo’s Italian Cafe “still owns the restaurant and everything inside the space,” wrote Chief Judge Jeffrey Sutton for the panel. “And it can still put every square foot of the premises to use, even if not for in-person dining use.”

Sutton cited similar decisions by two other federal appeals courts.

The 8th Circuit at St. Louis ruled in July that an Iowa dental clinic can’t recover for COVID-19 “business interruption” losses under an insurance policy that covers “accidental physical loss or accidental physical damage.” The case is Oral Surgeons PC v. the Cincinnati Insurance Co.

The 11th Circuit at Atlanta ruled in August against a dental practice that also sought coverage for business interruption. The case is Gilreath Family & Cosmetic Dentistry Inc. v. the Cincinnati Insurance Co.

The 6th Circuit case is Santo’s Italian Cafe v. Acuity Insurance Co.

The appeals court in Santo’s Italian Cafe acknowledged that its decision “leaves a hard reality about insurance. It is not a general safety net for all dangers.”

“Fair pricing of insurance turns on correctly accounting for the likelihood of the occurrence of each defined peril and the cost of covering it,” Sutton wrote. “Efforts to push coverage beyond its terms creates a mismatch, an insurance product that covers something no one paid for and, worse, runs the risk of leaving insufficient funds to pay for perils that insureds did pay for. That is why courts must honor the coverage the parties did—and did not—provide for in their written contracts of insurance.”

A lawyer for the restaurant told Law.com that his team will consider a petition for en banc review.