It's a golden age for Texas' oil and gas transactional lawyers

Illustration by Lars Leetaru.

“Mud lawyers,” that’s what they called them—oil and gas attorneys, viewed for decades as second-class citizens in the world of corporate transactional law. They dealt in wet, smelly products pulled from the ground, relegated to practicing in Dallas and Houston, earning subpar rates compared to their brethren in the white-shoe firms in New York City. Other law firms branched out to start alternative energy practices that focused on solar, wind and geothermal.

Then a weird thing happened during the past few years. Like Jed Clampett “shootin’ at some food,” energy companies and financial investors rediscovered oil and natural gas.

The number of mergers, acquisitions, joint ventures and asset divestitures in the oil and gas sector—much of it involving investment in areas targeted for possible major oil or gas deposits in shale rock—doubled during the past five years, according to Mergermarket, an independent global M&A research firm affiliated with the Financial Times.

Almost weekly an upstream, downstream or midstream company is announcing another billion-dollar deal. Private equity firms from New York are pouring billions of dollars into the “Oil Patch” in hopes of hitting a gusher. International institutions such as Chinese- and Indian-owned energy companies have dumped billions into joint ventures with Texas-based oil and gas businesses.

“There’s a lot of money flowing into energy and Texas right now,” says Stephen Coats, a managing partner and general counsel at New York City-based Riverstone Holdings, a private equity firm with more than $22 billion in investments in the energy sector, including several billion in Texas.

And the pickings aren’t likely to be slim anytime soon. The International Energy Agency—formed by 28 member nations to research energy issues and respond to disruptions in the oil supply—predicts in its World Energy Outlook 2012 (PDF) that the U.S. will become the world’s top oil producer by the end of the decade, overtaking Saudi Arabia, and will be a net exporter of oil by 2030.

The result, according to legal industry analysts, is that energy transactional law has been on fire. The traditional energy powerhouses, including Baker Botts and Vinson & Elkins, are experiencing record profits. Global firms such as Latham & Watkins, Simpson Thacher & Bartlett, Sidley Austin and Weil Gotshal & Manges have successfully swept into the sector through strategic lateral hires and are grabbing a significant slice of the pie. General counsel at more than a dozen energy companies say they have significantly expanded their in-house legal departments while simultaneously increasing the amount of work awarded to outside counsel.

Mark Kelly: “A technology shift has provided a sea change in the U.S. in developing and producing energy.” Photo by Todd Spoth.

Legal action is also up on the litigation side, though the anticipated activity regarding fracking—using horizontal drilling and chemical infusion to mine oil and gas from shale deposits–—has not yet materialized in any measurable manner.

To date, more than three dozen lawsuits and 10 class actions have focused on contaminated drinking water from fracking operations in Colorado, New York, North Dakota, Ohio, Pennsylvania and Texas. Even a handful of state and local governments have sued, claiming that horizontal drilling and hydraulic fracking techniques violated various trespassing, public nuisance and pollution standards. But despite the infamous videos of people setting fire to the water that comes out of their faucets or sits in their toilets, the suits have languished or faltered because plaintiffs experts have had difficulty proving causation.

GLORY DAYS

“This is the golden age if you are an energy lawyer,” says David Poole, general counsel for Range Resources Corp. in Fort Worth. “Only a decade ago, no one wanted to be identified as an oil and gas lawyer. Today, everyone wants to be able to put on their bio that they have experience doing oil and gas deals.”

At the same time that the amount of energy-related work has skyrocketed, the rates those lawyers charge have also jumped. Top energy partners are now billing between $800 and $1,075 an hour, rates that were unheard of for the oil and gas sector only a few years ago.

“If you have a strong energy practice, your law firm is doing very well,” says Ward Bower, a principal at Altman Weil Inc., a national consulting firm based in Newtown Square, Pa. “If you have energy transactional experience, you are in demand. I don’t think a sector can get any hotter, and there’s no end in sight.”

The numbers bear out that optimism. During the first three quarters of 2012, energy transactions accounted for more than 23 percent of all transactions in the U.S., and nearly double the number of technology, retail or pharmaceuticals transactions, according to Mergermarket. Four of the 10 largest U.S. deals announced during the first nine months of 2012 involved oil and gas companies—all of them based in Texas and all supported by dozens of energy lawyers based in Texas.

The research firm found that between Jan. 1, 2010, and Sept. 30, 2012, U.S.-based energy companies transacted 740 M&A deals valued at $463.6 billion. During that same 33-month period, there were more than 2,454 energy deals globally valued at more than $1 trillion. Texas-based energy companies alone did more than 292 mergers, acquisitions, sales or joint ventures at a price tag of $237 billion, Mergermarket reports.

“The trajectory for energy companies is only upward because they are better at finding more assets and more efficient at getting those assets,” says Chad Watt, who monitors M&A activity in Texas for Mergermarket. “None of the energy companies are in danger of becoming Myspace. They will always have significant value because their assets will always have significant value, and the lawyers who represent them will always have work.”

Watt says hundreds of additional oil and gas deals aren’t included in the statistics because they either involve private companies that kept the details confidential or the deals were valued at less than $5 million.

Everyone gives the nod for the resurgence in oil and gas law to the extraordinary natural gas deposits found in shale formations from Texas to Pennsylvania.

“A technology shift has provided a sea change in the U.S. in developing and producing energy. And, as a result, the energy business has become capital-intensive,” says Mark Kelly, a partner at Vinson & Elkins in Houston and a longtime energy lawyer. “U.S. companies frequently need capital, and a lot of foreign companies, including state-owned energy companies, are looking to invest.”

Kelly, who specializes in capital markets, says energy companies are “constantly retuning their assets, looking for good opportunities but also selling assets that don’t fit into their focused strategy.”

Pioneer Natural Resources is an Irving, Texas-based energy company with a market cap of $12.7 billion that is one of the best-performing energy businesses on the Standard & Poor’s 500 index. During the past six years, Pioneer has completely reformed its extensive portfolio, selling high-risk, high-reward assets around the world and reinvesting in shale opportunities closer to home.

In 2006, Pioneer sold its oil and gas assets in Argentina for $675 million. In 2011, the company sold its Tunisian oil exploration and production assets to Austria’s largest industrial company for $866 million. And this past August, Pioneer shed its South African assets for $52 million.

On the flip side, Pioneer has aggressively expanded into the Spraberry oil field in west Texas, the Eagle Ford Shale in south Texas, the Barnett Shale in north Texas and the North Slope in Alaska. In 2011, Pioneer closed a highly complex $1.3 billion Eagle Ford Shale joint venture with India-based Reliance Industries.

“Our company is growing at a very fast pace,” says Mark Berg, Pioneer’s general counsel. During the past five years, Berg has increased the size of his in-house legal team from seven to 15 lawyers. “Our challenge in the legal department is to keep up with our operations. From managing the legal functions to advising and executing business decisions, the role of the legal department at Pioneer has changed dramatically since I arrived.”

LAWYERS FIRST

While Berg, Poole and other energy general counsel say they are always seeking to keep down legal fees, their No. 1 priority is hiring lawyers they know and trust to get the deal done.

“In the big M&A transactions, the cost of the legal team doesn’t matter nearly as much,” says Andrew Wright, deputy general counsel at Energy Future Holdings in Dallas. “You want the best. You want lawyers who have done these kinds of deals before. They have the expertise.

“Most in-house lawyers have a handful of outside lawyers they know and trust, and we call them over and over,” Wright says. “I hire lawyers, not law firms.”

That’s good news for the law firms doing the deals. V&E and Latham dominate the M&A league tables for energy in the U.S. and globally. But Baker Botts, Bracewell & Giuliani and Jones Day are getting their fair share of the action.

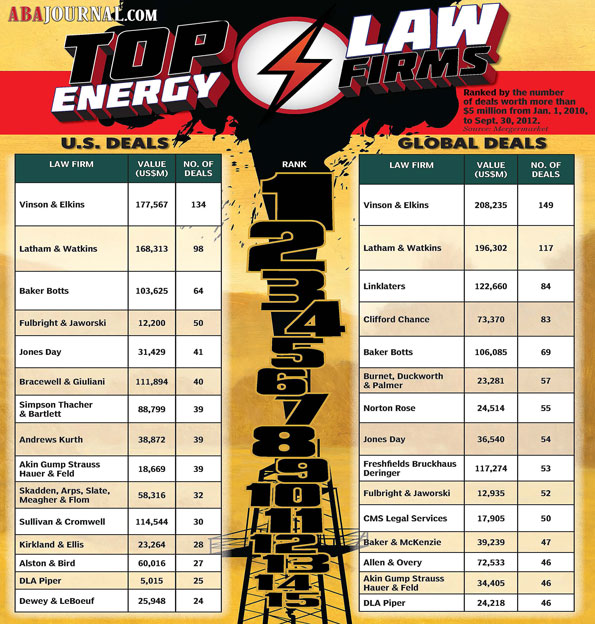

According to Mergermarket, Vinson & Elkins handled 134 U.S.-based energy transactions valued at $177.6 billion from Jan. 1, 2010, to Sept. 30, 2012. Latham was second, advising companies on 98 deals that had a price tag of $168.3 billion. For global energy deals, V&E led all law firms by advising on 149 transactions valued at $208.2 billion. Latham was again second, handling 117 deals worth $196.3 billion. Two firms in London—Linklaters and Clifford Chance—ranked third and fourth.

“The presence of V&E and Latham atop the league tables for Texas, the U.S. and the world highlights the importance of Texas businesses and the law firms that advise them,” says Mergermarket’s Watt. “V&E and Latham advised on a wide spectrum of deals within the energy universe. It wasn’t just acquisitions, asset divestitures or IPOs, and it wasn’t just upstream producers doing deals. These two firms’ continued domination of the leader board shows the value of having a diversified transactional practice group.”

The fact that Vinson & Elkins and Latham are the top two energy-transaction law firms in Texas perfectly demonstrates the dynamics of the legal market for the energy sector, according to Altman Weil’s Bower and other industry analysts.

Michael Dillard: “Energy has been off-the-charts hot. …The past couple of months have been [our busiest ever].” Photo by Todd Spoth.

V&E has deep ties to the Oil Patch. More than a dozen V&E partners worked for energy companies in positions ranging from roughnecks to engineers. Several former V&E lawyers now serve as general counsel at energy companies, including Richard McGee at Houston-based Plains All American Pipeline, Berg at Pioneer Natural Resources, Jim Matthews at Denbury Resources in Plano, Texas, and Stacey Doré at Energy Future Holdings in Dallas.

“V&E’s grip on the energy sector is very strong and they show no signs of losing their longtime advantage,” says Bower.

By contrast, Latham only opened its Houston office in February 2010. Founded in Los Angeles, the 2,000-lawyer firm successfully lured elite energy transactional partners away from Texas-based firms. Latham now has more than 50 lawyers in Houston and plans to expand to 65 this year.

“The deal numbers don’t surprise me because we find ourselves sitting across the table from V&E lawyers in many of our deals,” says Michael Dillard, managing partner of Latham’s Houston office. “I think it has become a two-horse race” for the larger energy deals.

“Energy has been off-the-charts hot,” he says. “Houston has been the busiest office on a per-lawyer basis of any of Latham’s 31 offices. And the past couple months have been the busiest we’ve ever experienced.”

V&E partner Keith Fullenweider, who leads the firm’s M&A and private equity practice, says 2012 has been another record year for his firm’s energy practice.

“The M&A energy work at these firms is among the best and most sophisticated in the world,” says Fullenweider, who has represented Fort Worth-based TPG Capital in numerous recent energy transactions. “Keep in mind that expertise in the energy sector goes beyond M&A to practices such as tax and regulatory, and those are also huge strengths for us.”

MORE AT THE DOOR

Latham’s emergence as a powerhouse in Houston shines the spotlight on the fact that so many national law firms have burst into the Texas legal market in recent years. And legal industry analysts say that at least a half-dozen more national firms are trying to find a way to open a presence in the state in hopes of grabbing some of the oil and gas work.

“Lawyers are smart people who are opportunistic,” Poole says. “We went through a long period in Texas where there wasn’t a lot of interest by younger lawyers in oil and gas.”

None of this, of course, means the other Texas firms with energy practices are suffering. Baker Botts advised 64 energy companies in deals valued at $103.6 billion, according to the Mergermarket survey. Bracewell & Giuliani, Fulbright & Jaworski, Andrews Kurth and Akin Gump Strauss Hauer & Feld were not far behind.

“M&A activity in Texas and throughout the energy industry should remain strong through 2013,” says David Kirkland, chair of Baker Botts’ corporate practice. “A number of companies continue to look for businesses that will add value as they seek to position themselves for changes that may affect the sector over the next few years.”

Not all energy work for lawyers involves M&A activity. For example, Dallas-based Thompson & Knight handled more than $68 billion in energy loan transactions for clients, a statistic that doesn’t even show up in the Mergermarket data.

A growing number of New York City-based firms—including perennial Wall Street giants Cravath Swaine & Moore; Wachtell, Lipton, Rosen & Katz; and Sullivan & Cromwell—are grabbing a slice of some of the larger energy deals, especially those involving private equity firms and investment banks.

One New York firm that has made a concerted effort to push into the energy sector is Weil Gotshal & Manges, which was the lead law firm in the biggest energy deal of 2012. Weil lawyers in Dallas and New York represented Houston-based Kinder Morgan in its acquisition of crosstown energy company El Paso Corp. for $23 billion. Kinder Morgan’s general counsel, Joe Listengart, and others have described the transaction as one of the largest and most complicated energy deals ever.

“The deal faced significant obstacles from the start, including the fact that El Paso didn’t want to sell,” says Weil energy partner Rodney Moore. “There were issues with the SEC and the FTC.”

Adding to the complexity was the fact that El Paso was in the middle of a separate transaction to sell some of its exploration and production assets to New York City-based Apollo Global Management and Riverstone Holdings for $7.15 billion.

More than 50 lawyers from a half-dozen law firms—including Bracewell & Giuliani, V&E, Locke Lord Bissell & Liddell, Akin Gump and Latham & Watkins—worked on the transaction. Weil’s team billed more than 16,000 hours during the six months spent working on the matter at rates between $450 and $1,000 an hour.

“We had to close three separate deals, and the dominoes had to fall in a certain way and in a specific order,” Listengart says. “Weil is not a cheap law firm, but the team executed brilliantly and were well worth the price.”