Get a handle on student loan debt

Shutterstock.com

U.S. student loan debt is estimated at $1 trillion. If graduating into a recession makes student loan repayment problematic for you, consider these tips for managing debt, instead of it managing you:

Research. Learn what you owe and who you owe. Consult the National Student Loan Data System for totals owed on federal loans. For private loans, says Robin Wells, a senior vice president at Country Club Bank in Kansas City, Mo., “know your banker. Have an actual person to call for answers.”

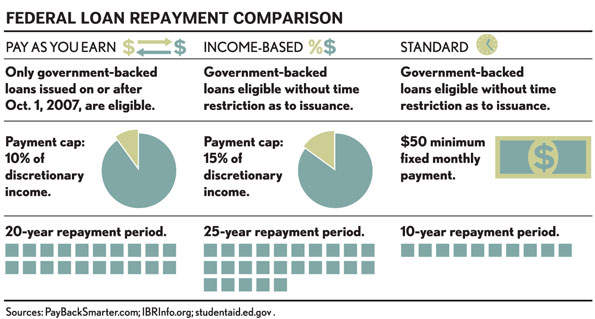

Numbers Crunch. Do-it-yourself calculators on forbearance, deferment, pay as you earn, consolidation and the Public Service Loan Forgiveness Program exist at the Federal Student Aid website, PayBackSmarter.com or IBRInfo.org. “Speak with loan counselors. They want to help you find the payment plan that fits your life—it ultimately makes their life easier too,” says Jerry L. Maddox, an associate at Paine, Tarwater and Bickers in Austin, Texas. Focus on What You Can Control. Employed with more expenses than income? Consider income-based repayment options such as pay-as-you-earn or income-contingent repayment. Few private lenders offer loan consolidation, but, Wells says, “if you’re employed with a good credit score, visit a community bank. Ask about options for better stability.” No job? Explore forbearance or deferring payments for up to three years on government-funded loans. “Private lender requirements vary,” says Wells. “Be up front with your banker about it.”

Automate. “I set up a pay plan that automatically removes funds from my bank account to pay my loans when they are due,” Maddox says. “That way I can rest assured knowing my loan payments will be timely made. … I never really ‘see’ the money leave my account because it is withdrawn shortly after I am paid, and I budget my living expenses around my ‘post-loan payment’ salary.”

Think long-term. “Avoid default,” says Wells. “The loan amount becomes greater because interest accumulation continues with deferment or certain renegotiations, but defaulting brings worse consequences.” Tough job search? A “default” mark dings the alarm bells for those employers (and landlords) who conduct background checks.

Finally, if you’re physically healthy and contemplating bankruptcy—stop. Even if Congress passes the two pending bills (H.R. 532, S-114) proposing bankruptcy discharge for private student debt, the other 85 percent of government loan holders would continue to be on the hook.

Graphics by Adam Weiskind

Susan A. Berson is a partner with the Berson Law Group of Leawood, Kan.