ABA Treasurer's Report for FY2020

Kevin Shepherd: “Despite the adverse and unprecedented effects of the pandemic on our operations, our association increased its net assets by $8.2 million in fiscal year 2020.” Photo courtesy of Venable

Each year, the ABA treasurer provides a report on the association’s finances that is printed here in the ABA Journal. In these reports, I will seek to provide helpful information about the association’s financial health as well as current and relevant trends.

In my first Journal report as treasurer, I will cover the association’s fiscal year 2020 audited results, finances through the first eight months of fiscal year 2021 (unaudited), trends in grant revenue and progress made on the fiscal year 2022 budget.

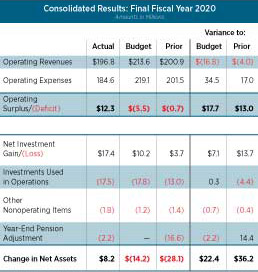

Fiscal year 2020 consolidated results

The fiscal year-end financial statement audit was successful. We received a clean (unqualified) opinion from our auditor, Grant Thornton. The ABA financial statements and audit report are posted online at ABAJournal.com/audit_report2020.

Fiscal year 2020 was extremely challenging, as our association and the entire world worked through the COVID-19 pandemic. Despite the adverse and unprecedented effects of the pandemic on our operations, our association increased its net assets by $8.2 million in fiscal year 2020.

The association’s financial results for fiscal year 2020 were affected by three significant factors:

• The association launched an enhanced value proposition that provides more benefits and value to our members at a lower cost. ABA membership dues revenue declined by $12.6 million from fiscal year 2019 to $49.2 million, reflecting the lower pricing. We anticipated the reduced dues revenue in budgeting for fiscal year 2020.

• Financial results benefited from two significant adjustments to implement new accounting rules. These adjustments improved both operating revenues and net assets by $18.8 million. These new accounting rules accelerate the recognition of revenue for certain grants ($15.4 million) and require us to recognize revenue for contribution pledges ($3.4 million). Without these adjustments, the operating revenue of $196.8 million would have been $178.0 million.

• The pandemic struck in the early part of the calendar year and required us to shut down our offices, immediately transition our staff to remote working, and cancel all in-person meetings and related travel. Largely due to the pandemic, fiscal year 2020 operating revenues (excluding the effect of the accounting changes discussed) were $35.6 million below budget. Fortunately, we were able to mitigate nearly all of that revenue shortfall by reducing expenses to $34.5 million below budget.

Chart by Sara Wadford/ABA Journal

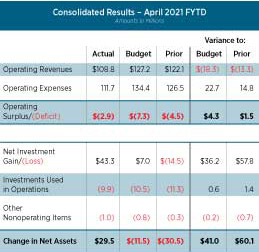

Fiscal year 2021 results through April 30

The first eight months of fiscal year 2021 continued to prove challenging as the pandemic shutdowns lingered. Our association has done an admirable job of managing expenses to mitigate the decline in operating revenues during the last year and a half of the pandemic. As we emerge from the pandemic and return to some semblance of normalcy (whatever form that may take), we will need to be equally vigilant in managing expenses while seeking to restore growth in operating revenue.

In the spring of 2020, when the fiscal year 2021 budget was produced, we knew that the pandemic would impact financial results, and we reduced revenue accordingly for what we knew at the time. Despite our attempt to right-size for fiscal year 2021, the pandemic has lasted longer than most expected, and it has affected all areas and operations of the association (most notably in-person meetings), resulting in much lower operating revenue than anticipated. Thankfully, our association was able to pivot quickly, and through April it has completely mitigated the revenue loss from the pandemic.

As you can see from the chart below, through April, our operating revenues are $18.3 million short of budget and $13.3 million less than last year. The revenue shortfall to budget and prior year is driven by pandemic-related meeting fee revenue and associated sponsorship shortfalls, as well as less membership dues revenue. Although nondues revenue in total has been significantly short of budget and prior year related to pandemic restrictions on in-person meetings, it is worth noting that grant revenue has met budget through April 2021 and is up $2.7 million compared to prior year.

The revenue shortfall is more than offset by reduced meetings and travel expenses and responsible expense management, as expenses are $22.7 million below budget and $14.8 million less than last year. The net result is an operating deficit of $2.9 million, which is better than both the budgeted and prior year’s operating deficit.

The real driver of our results through April is investment income, as the financial markets have been very strong. For the eight months ended April 30, investment earnings are $43.3 million, which is $36.2 million better than budget. Only $9.9 million of those investment earnings were used to support our operations. As a result, the association’s net assets increased by $29.5 million through the eight months ended April 30.

Chart by Sara Wadford/ABA Journal

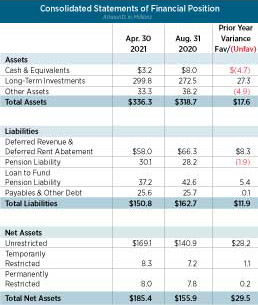

Financial position as of April 30

Our financial position remains very strong. The association has $336.3 million of assets and only $150.8 million of liabilities, resulting in net assets of $185.4 million, of which $169.1 million are unrestricted.

Chart by Sara Wadford/ABA Journal

Despite the impact of the pandemic, we have improved our net asset position by $29.5 million during the first eight months of fiscal 2021. This improvement was driven by both extraordinary investment performance, which increased our total assets, as well as a meaningful reduction in our total liabilities. We have continued to pay down our loan to fund the pension liability and manage cash effectively. In April 2020, as we entered the pandemic, we borrowed $10 million on our revolving credit facility (“revolver”) to refund meeting fees and sponsorships for canceled meetings. Yet despite the ongoing pandemic, we have paid down our debt by $9.2 million over the past year, as shown in the debt summary chart.

Chart by Sara Wadford/ABA Journal

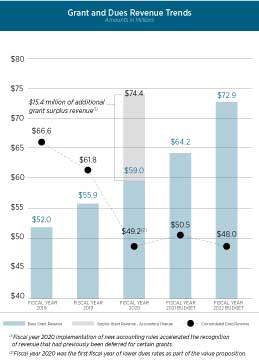

Grant revenue trends

For the eight months ended April 30, grants generated $42.8 million of revenue for the association. Over the past several years, the ABA has been recognized for the outstanding work it does for the public good. As such, the ABA has received increased grant funding to support the continuation of these good works both domestically and abroad. Of note, in our domestic portfolio, the ABA’s work supporting representation of unaccompanied minors at the southern border has received significant increases in grant funding. Internationally, in our Rule of Law Initiative portfolio, we continue to increase work in emerging countries. The fact that outside parties financially support these activities is prima facie evidence of the value of the work the association performs.

Chart by Sara Wadford/ABA Journal

The past two years have proved to be challenging to grow dues revenue. First, the pandemic adversely affected the retention rate for long-tenured dues-paying members. Second, the value proposition launch in 2020 included restructuring of the dues rates for members, which reduced overall dues revenue.

Grants and other sources of nondues revenue will thus allow the association to continue to thrive while navigating through the lingering pandemic effects. The grant and dues revenue trends chart illustrates the increase in grant segment revenue and decrease in dues revenue earned through fiscal year 2020 and projected through fiscal year 2022.

Fiscal year 2022 budget

It is going to take time to grow membership and for nondues revenue to return to pre-pandemic levels. We are thus prudently budgeting for lower general operations revenue in fiscal year 2022 than in previous years. The lower budgeted revenue requires that we similarly reduce general operations budgeted expenses, as we must balance the portion of the budget that supports our core operations.

As such, the preliminary general operations budget for fiscal year 2022 is $73.9 million, reflecting a reduction of $4.5 million from fiscal year 2021. Despite this reduction for general operations, thanks to continued grant success, our consolidated ABA revenue remains consistent with prior years at approximately $200 million.

The budget is preliminary, as much can occur in the last months of fiscal year 2021. We are encouraged by the diligent efforts of staff and our member leaders to find efficiencies in their areas while not materially disrupting efforts to acquire, engage and retain members.

The COVID-19 pandemic has presented significant challenges. The difficult choices that are being made during the fiscal year 2022 budgeting process will help preserve the long-term financial health of the association.

We will continue our efforts to grow membership and identify strategies to grow nondues revenue, and we will remain vigilant in managing the investment funding that supports our core operations. These efforts will be especially important as we emerge from the pandemic.

Thank you for the opportunity to serve as your treasurer.

Write a letter to the editor, share a story tip or update, or report an error.