ABA Treasurer's Report - Fiscal Year 2023

ABA Treasurer Fritz Langrock

Each year, the treasurer provides a report on the association’s finances to be published in the ABA Journal. In these reports, I seek to provide helpful information about the association’s financial health.

In this report, I cover the association’s fiscal year 2023 audited results; finances through the first eight months of fiscal year 2024 (unaudited); an update on the association’s pension liability; discussion of a dues rate increase for fiscal year 2025; and progress made on the fiscal year 2025 budget.

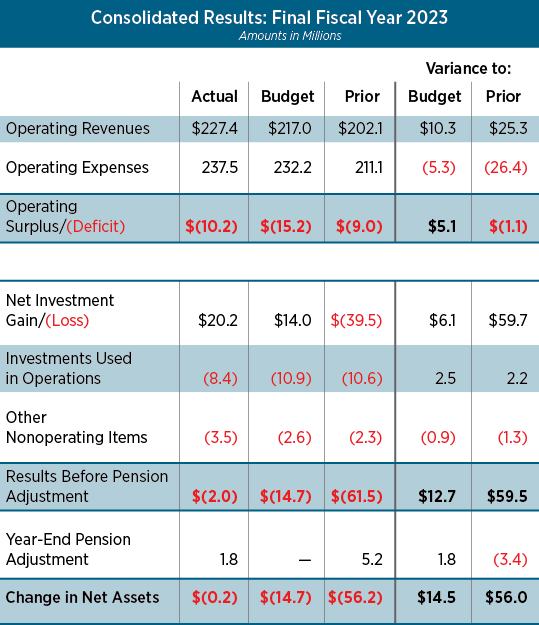

Fiscal year 2023 consolidated results

The fiscal year-end 2023 financial statement audit was successful. We received a clean (unqualified) opinion from our auditor, Grant Thornton. You can find the ABA financial statements and audit report at ABAJournal.com/FY2023.

Fiscal year 2023 saw increased activity, highlighted by our grants portfolio. Consolidated revenue increased by $25.3 million to $227.4 million, including total dues revenue of $43.1 million on over 170,000 dues-paying members. We also had significant meetings- and publications-related nondues revenue.

Total grants revenue of $114.5 million was more than twice as high as it was just five years ago, was $21.1 million higher than fiscal year 2023 budget and $21.9 million higher than fiscal year 2022. While grant activity significantly increased, that revenue is not available for association use, but rather for the special projects for which the grants were made.

Overall, the association’s operating deficit was $10.2 million, which was $5.1 million favorable to budget but $1.1 million higher than prior year.

Consolidated total change in net assets includes the operating deficit of $10.2 million as well as nonoperating (“below the line”) results. Below the operating line, the association had $20.2 million of investment gains, used $8.4 million of investments to support operations and had $3.5 million of nonoperating net expense. A $1.8 million year-end pension gain was recorded based on the determination of the association’s pension obligation by the association’s independent actuaries. As a result of the activity above, despite the $10.2 million operating deficit, the association broke even in fiscal year 2023, as net assets decreased by only $0.2 million.

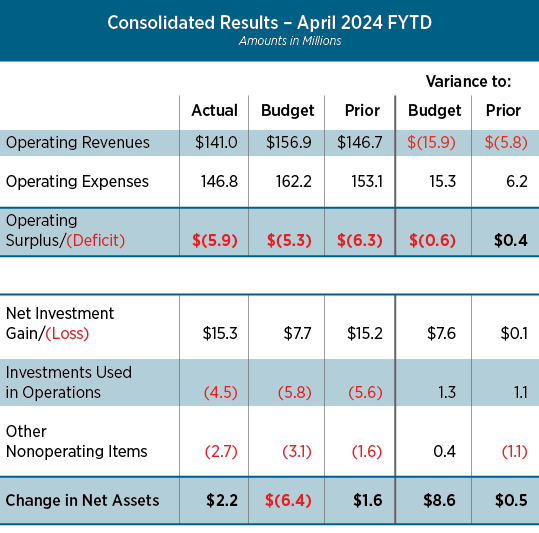

Fiscal year 2024 through April 30, 2024

Through April of fiscal year 2024, while consolidated association revenue of $141.0 is $15.9 million lower than budget, association expense is also $15.3 million lower, leaving a net unfavorable variance to budget of $0.6 million. The lower-than-anticipated revenue and expense are primarily reflective of less grant activity than anticipated in our global programs portfolio.

While we will not be able to make up this grant shortfall by the end of fiscal year 2024, we have recently secured several large multiyear grants that will restore the long-term positive trends we have seen within the global programs portfolio the last several years.

Overall, the association’s operating deficit of $5.9 million is $0.6 million higher than budget and $0.4 million better than prior year to date. While it is important to reduce the consolidated operating deficit of $5.9 million, there is some good news in that favorable financial market conditions have meant $15.3 million of investment gains below the operating line. Including all operating and nonoperating activity, the association has increased its net assets by $2.2 million through April of FY2024.

Financial position as of April 30, 2024

The association has total assets of $349.6 million and liabilities of $181.2 million, resulting in total net assets of $168.5 million. Of the $168.5 million of total net assets, $116.4 million are unrestricted Sections, Divisions and Forums (S/D/F) net assets. The remaining $52.1 million are general operations and Fund for Justice and Education net assets (of which $17.2 million are restricted). The association’s balance sheet is at the top of the next column.

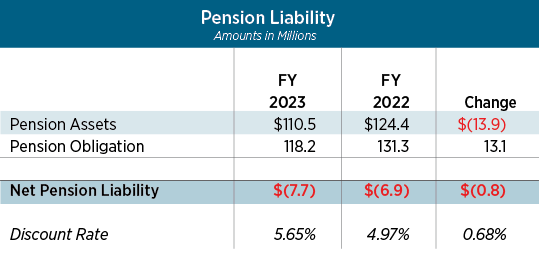

Pension liability update

The association’s pension liability is calculated by our actuaries once per year. The calculated balance is as of the end of the last fiscal year, or Aug. 31, 2023.

During fiscal year 2023, our total pension liability increased by a modest $0.8 million. The pension plan is a separate legal entity that has its own assets, consisting of high-quality liquid investments. The total pension liability is determined as the difference between the pension’s assets and the plan’s obligation, or the amount owed in retirement benefits to current and future retirees.

During the year, the components of the pension liability changed as shown by the pension liability table in the next column.

The table above shows that the pension obligation component of the pension liability declined by $13.1 million in FY2023.

The increase in interest rates (and related discount rate) accounted for a significant portion of this decline, as the pension obligation is sensitive to interest rates.

Because we have been so successful over the past eight years in improving the funded status of the pension plan, we have been able to reduce the risk exposure of the pension assets. That is why the $13.9 million decline in pension assets tracked so closely with the $13.1 million change in pension obligation—pension asset allocation has been shifted to better correlate asset returns with pension obligation changes to minimize interest rate risk.

While the total pension liability increased by $0.8 million in fiscal year 2023, the table below illustrates that our total pension-related obligation improved by $7.4 million in fiscal year 2023 and by $68 million since October 2015. Over the last eight years, through several low-cost loans, the association has borrowed a total of $80 million to help fund the pension plan; as of the end of fiscal year 2023, $60.7 million of that $80 million has been repaid, leaving an outstanding pension-related loan balance of $19.3 million.

The total pension-related obligation—which is composed of the sum of the total pension liability discussed above and the outstanding balance on loans to fund the pension plan—has decreased from $95 million in October 2015 to $27 million as of the end of fiscal year 2023, a decrease of about 72%.

The tremendous progress that has been made on this important issue has resulted in a significantly lower and more predictable overall liability.

Fiscal year 2025 dues rate increase

Effective Sept. 1, the beginning of fiscal year 2025, the association will implement a dues rate increase of $45 across most general dues categories, the first significant general dues rate increase in a decade.

This increase does not apply to the separate and additional dues paid by members who join S/D/F, which are charged separately by entity.

Over the past decade, according to the consumer price index, inflation has grown by over 30% cumulatively. This inflation has put significant pressure on expenses for the association without the corresponding increases in revenue from increasing dues rates or dues-paying members; in fact, dues rates were simplified and significantly reduced effective fiscal year 2020. To ensure the long-term health of the association, we must generate more revenue through operating activities to prevent operating deficits, avoid depleting our investments, and most importantly, to continue investing in our membership product. The dues increase is a step in this direction.

We estimate the increased dues rates will generate an incremental $3 million of revenue. While half of the $3 million of incremental revenue will go toward addressing the annual inflationary pressure on expenses (e.g., merit increases, fringe benefits, facilities costs), we plan to invest the other half into the membership product through a new research and development function that will focus on the following advances:

• Improvements to the website, prioritizing findability, personalization and the new member experience.

• Implementation of a user testing tool to help improve usability of the ABA website and other technology.

• Implementation of a feature request tool to enable ABA members to request, discuss and vote on desired features, products and content.

• Continued investment in our learning management system, including improved functionality and original content development.

We believe the additional revenue from this dues rate increase will help fund improvements that will allow us to increase acquisition and retention of members by improving the member experience.

Fiscal year 2025 budget

As of this writing, staff has completed input of our association’s preliminary fiscal year 2025 budget. Preliminary consolidated budgeted operating revenue is about $229.5 million, slightly higher than the fiscal year 2024 budget, with all four of our reporting segments (General Operations; Sections, Divisions and Forums; Grants; Gifts and Endowments) close to prior year budget.

S/D/F will have an opportunity to update their budgets in August after the ABA Annual Meeting. They are planning an expansion of shared staffing for those S/D/F that wish to participate, and we hope they will provide better services. Staff believes that expanded shared staffing can lead to increased effectiveness and efficiency, in particular:

• Better effectiveness, as associates can specialize in areas as opposed to being expected to do everything well.

• Better efficiency, as economies of scale are realized when serving more entities.

• Improved career pathing for staff.

• Standardization of processes—shared staffing will allow best practices to be implemented more effectively.

The budget is preliminary, as much can occur in the remaining months of fiscal year 2024. We look forward to a successful fiscal year 2025 and beyond.

Thank you for the opportunity to serve as your treasurer.