ABA Treasurer's Report - Fiscal Year 2022

Kevin L. Shepherd

Each year, the treasurer provides a report on the association’s finances that is published in the ABA Journal. In these reports, I seek to provide helpful information about the association’s financial health as well as current and relevant trends.

In my third and final Journal report as ABA treasurer, I will cover the association’s fiscal year 2022 audited results; finances through the first eight months of fiscal year 2023 (unaudited); an update on the association’s pension liability; progress made on the fiscal year 2024 budget; and insights from the association’s new data strategy group.

Fiscal year 2022 consolidated results

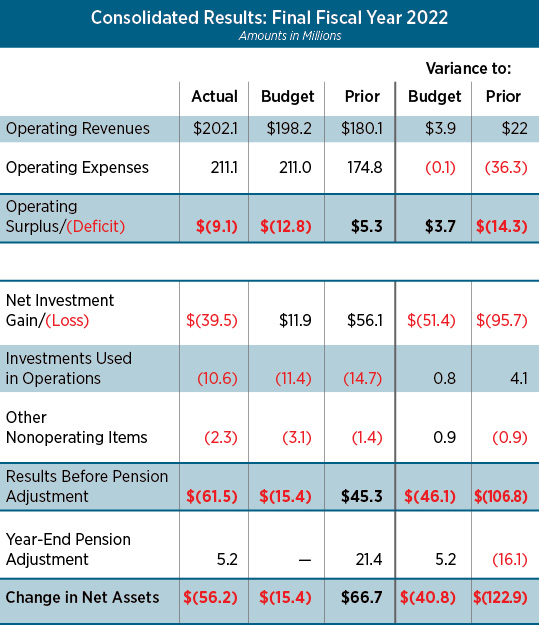

The fiscal year-end 2022 financial statement audit was successful. We received a clean (unqualified) opinion from our auditor, Grant Thornton. See the ABA financial statements and audit report at ABAJournal.com/audit_report_2022.

Fiscal year 2022 saw increased activity as the effects of the pandemic on the association’s operations receded. Consolidated revenue increased by $22 million to $202.1 million, highlighted by our grants portfolio. Total grant revenue of $92.7 million was $19.7 million higher than budget and $14.5 million higher than prior year. Consolidated meeting fee revenue increased by almost $10 million over fiscal year 2021.

But we still faced membership challenges. Although dues-paying membership remained stable year over year, dues revenue declined, as an increasing proportion of dues-paying members are younger members who pay lower dues rates. Dues revenue was $1.2 million lower than prior year.

Overall, the association’s net operating deficit was $9.1 million compared to last year’s operating surplus of $5.3 million.

Below the operating line, the association was not spared from turbulent financial markets; it reported $39.5 million of investment losses. This reported loss is primarily due to a change in the market value of the investment portfolio and not realized losses from sale. The association did use $10.6 million of investments to support operations, had $2.3 million of nonoperating net expense and had a $5.2 million pension gain after determination of the association’s pension liability by our independent actuaries. A more in-depth discussion of the association’s pension obligation will be provided later in this report. As a result of the activity above, the association’s net assets decreased by $56.2 million through the 12 months ended Aug. 31, 2022.

Although investment losses due to volatility in investment markets were the primary driver of the $56.2 million decrease in net assets during fiscal year 2022, our total net assets actually have increased since fiscal year 2020, aided by extraordinary investment gains in fiscal year 2021. Our financial discipline is highlighted by the fact that the association managed to increase its net assets over the past three years despite the challenge posed by the pandemic.

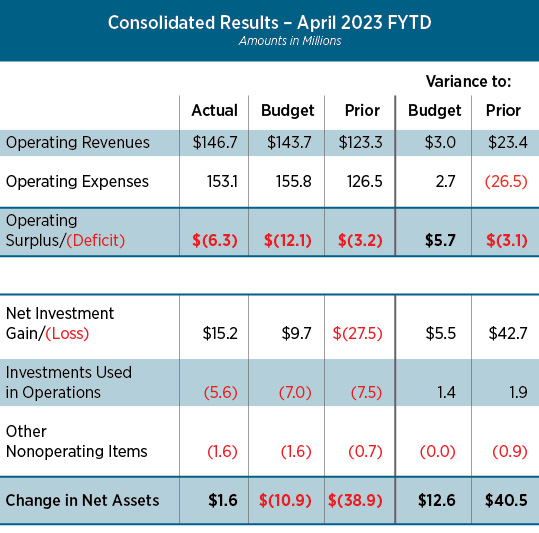

Fiscal year 2023 results through April 30

Fiscal year 2023 has seen a continuation of several recent operating trends. As shown on the table on the following page, consolidated operating revenue is $3.0 million favorable to budget and $23.4 million favorable to prior year, while consolidated operating expense is $2.7 million lower than budget and $26.5 million higher than prior year.

This increased activity over prior year to date is primarily due to about $20 million more in grant work performed by the association. Another positive trend is the continued increase in in-person meetings, as consolidated meeting fees are about $6 million higher than prior year to date, and the month of March saw the highest amount of meeting fees since March 2019, about a year before the pandemic began.

Overall, the association’s consolidated operating deficit is $6.3 million, $5.7 million lower than budgeted, but $3.1 million higher than prior year to date. More than offsetting the operating deficit are the association’s results below the operating line. With stronger financial markets, the association’s investment portfolio has rebounded, providing $15.2 million of investment gains. The association also has used $5.6 million of investments to support operations and has $1.6 million of nonoperating expense. As a result of all operating and nonoperating activity, the association’s net assets have increased by $1.6 million through the first eight months of fiscal year 2023.

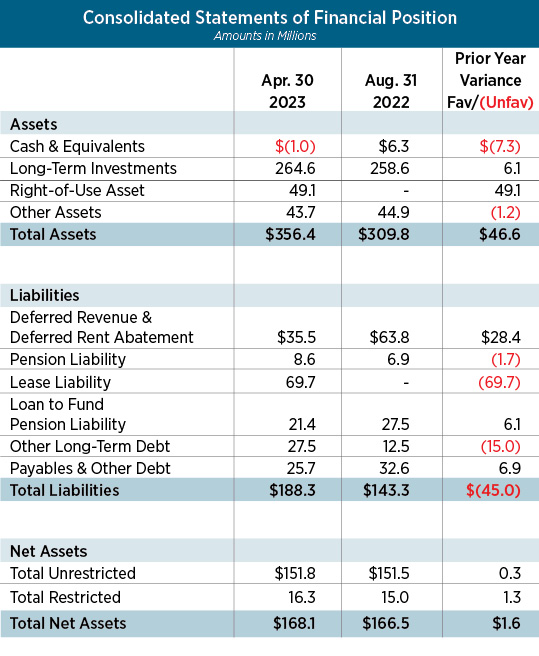

Financial position as of April 30

The rebound in our investment portfolio has aided the association’s already healthy financial position. The association has total assets of $356.4 million and liabilities totaling $188.3 million, resulting in total net assets of $168.1 million. Of the $168.1 million of total net assets, $151.8 million are unrestricted and $16.3 million are restricted in our Fund for Justice and Education. Set forth in the next column is the association’s balance sheet.

Association total assets increased by $46.6 million to $356.4 million since Aug. 31, 2022, primarily due to a new lease-related accounting rule that became effective in fiscal year 2023 that is meant to increase the visibility of lease obligations.

The impact of the new rule was to increase total lease-related liabilities by $49.1 million. An offsetting “right of use asset” also is recorded to recognize the association’s right to utilize the leased asset. The new rule does not change the lease expense or net assets. It simply results in a $49.1 million increase in both assets and liabilities.

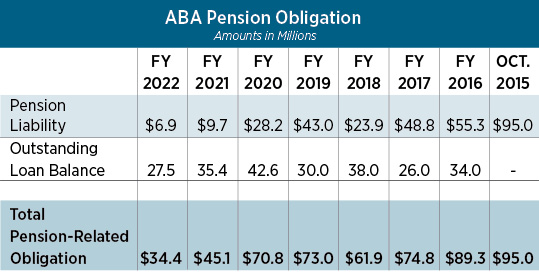

Pension liability update

The pension plan is a separate legal entity that has its own assets, consisting of high-quality liquid investments. The pension liability is determined as the difference between the pension’s assets and the plan’s obligation, or the amount owed to current and future retirees in retirement benefits.

The pension liability is calculated by our actuaries once per year. The calculated balance is as of the end of the fiscal year, or Aug. 31, 2022.

During the 2022 fiscal year, our net pension liability decreased by $2.8 million, composed of a $36.5 million reduction in the pension obligation primarily from increasing interest rates (and the related rate at which future benefit amounts owed are discounted), partially offset by a $33.8 million reduction in our pension assets.

Because we have been so successful over the past seven years in improving the funded status of the pension plan, we have been able to reduce the risk exposure of the pension assets.

That is why the $33.8 million decline in pension assets tracked so closely with the $36.5 million change in pension obligation—pension asset allocation has been shifted to better correlate asset returns with pension obligation changes to minimize interest rate risk.

The table below illustrates how we have accomplished the significantly improved funded status of our pension plan.

Over the last seven years, the association has borrowed a total of $80 million through several low-cost loans to help fund the pension plan; as of the end of fiscal year 2022, $52.5 million of that $80 million has been repaid, leaving an outstanding pension-related loan balance of $27.5 million. The total pension-related obligation—composed of the sum of the net pension liability discussed above and the outstanding balance on loans to fund the pension plan—has decreased from $95 million in October 2015 to about $34 million as of the end of fiscal year 2022, a decrease of about two-thirds.

The tremendous progress that has been made on this important issue has resulted in producing a significantly lower and more predictable overall pension plan liability.

Fiscal year 2024 budget

As of this writing, staff has completed initial input of our association’s preliminary fiscal year 2024 budget. Preliminary consolidated budgeted revenue is about $228 million, an increase of about $11 million from the final fiscal year 2023 budget.

This increase is again highlighted by the growth of our grants portfolio. The fiscal year 2021 budget contemplated $64.2 million of grant revenue. Just three years later, the fiscal year 2024 grants segment budget of $108.2 million reflects a total increase of $44.0 million (68%) from the fiscal year 2021 budget, and a $14.8 million (16%) increase from the fiscal year 2023 budget. The increasing amount of grant funding we receive from unrelated third parties proves the value of the tremendous work we do to improve the world.

The association’s general operations budget is about $5 million lower than in fiscal year 2023, primarily due to rightsizing the membership dues budget to better reflect actual trends.

On an aggregate basis, budgets for sections, divisions and forums have remained stable year over year.

The budget is preliminary, as much can occur in the remaining months of fiscal year 2023. We look forward to a successful fiscal year 2024 and beyond.

Data strategy group insights

It is critical that the association allocates its resources to the places where they will achieve the greatest impact on increasing our membership and providing a return on investment. Achieving this requires a holistic understanding of the association’s challenges, opportunities and overall performance.

To that end, the association created a new internal data strategy department last year. This department is designed to help leverage membership, business and financial data to help groups throughout the organization ascertain real-time actionable and predictive insights, with a focus on improving the strategic and financial health of the organization and its business units. This department will help drive the organization toward a more data-driven culture to promote fact-based decisions that help the association achieve its critical business objectives.

We are already seeing the ways this function can empower the business. For example, the association’s content team engaged data strategy to test whether reducing the number of free articles per month improved membership conversion rates. The team determined that a simple change from three to two free articles per month significantly improved conversion rates. That change was promptly implemented.

More significantly, we have historically struggled to budget dues revenue accurately. We have been too reliant on aspirations and unrealistic external consultant projections. We are pleased to report that the fiscal year 2024 dues budget is heavily based on insights developed by the internal data strategy group. This budget was developed using sophisticated in-house statistical modeling that utilizes actual membership trends, including natural attrition, acquisition and retention. Actual performance for fiscal year 2023 is tracking closely to the model, which increases confidence in the fiscal year 2024 projections.

The ABA is a world-class organization—the definitive representative of the legal profession. It deserves a business operation that can deliver on that promise. This new group is a meaningful step in the right direction, and we look forward to seeing how these insights will transform the association.

As I conclude my term as treasurer, I want to extend my deep appreciation to our superb financial staff, led by Bill Phelan, the association’s chief financial officer. Bill and his staff make the hard financial work look easy. I will miss working with them on a daily basis, but I know that my successor, Fritz Langrock, will benefit from their commitment and expertise. I wish Fritz the best of luck and success in his new role as your treasurer.

Thank you for the opportunity to serve as your treasurer.