Friend's RV loan to Justice Thomas was apparently forgiven before principal fully paid, new Democratic report says

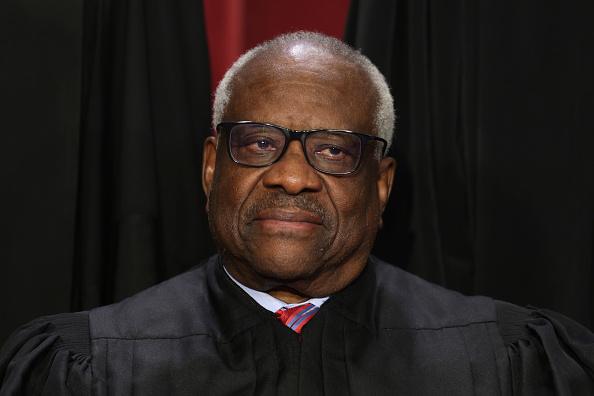

U.S. Supreme Court Justice Clarence Thomas poses for an official portrait in the Supreme Court building Oct. 7, 2022, in Washington, D.C. According to a new report, Thomas purchased a luxury RV with a loan of $267,230 from a wealthy friend. Photo by Alex Wong/Getty Images.

Documents suggest that U.S. Supreme Court Justice Clarence Thomas purchased his luxury RV with a loan of $267,230 from a wealthy friend who forgave "a substantial amount or even all of the principal balance," according to an Oct. 25 report by Democratic members of the U.S. Senate Committee on Finance.

The New York Times has the story on the Senate Committee on Finance investigation, spurred by an August story by the New York Times on the loan by Thomas’ friend Anthony Welters. Thomas used the money to buy a used Prevost Le Mirage XL Marathon, which is “a brand favored by touring rock bands and the super-wealthy,” the New York Times says.

Under the initial terms of the balloon loan made in December 1999, Thomas was to make annual interest payments of $20,042 for five years and then to pay off the principal in a lump sum. In 2004, however, Welters granted Thomas a 10-year extension that called for the same interest-only payments followed by payment of the principal.

Welters told the New York Times that the loan was “satisfied” in 2008. A November 2008 note that Welters wrote to Thomas and provided to the committee said he didn’t want to continue accepting payments because years of interest-only payments exceeded the principal amount. The New York Times says Welters didn’t get the math quite right because the roughly $20,000 in annual payments would have equaled about $180,000, not $267,000.

Welters provided just one canceled check for $20,042 as proof of the interest payments. He told the New York Times that he was unable to produce additional proof because the bank records that he sought no longer exist.

Elliot S. Berke, a lawyer for Thomas, told the New York Times that the loan “was never forgiven,” and “the Thomases made all payments to Mr. Welters on a regular basis until the terms of the agreement were satisfied in full.”

But Berke didn’t explain why Welters wrote a letter to Thomas in 2008 that said he wouldn’t seek additional payments. Berke also didn’t say whether his use of the word “satisfied” meant that Thomas repaid the principal in addition to making interest payments.

According to the New York Times, Thomas did not report a forgiven loan on financial disclosure forms.

It is unclear whether Thomas reported a forgiven loan as income to the Internal Revenue Service. According to a footnote in the Democratic report, a forgiven loan may be considered a taxable gift but not if it is a bona fide business transfer made at arm’s length and without “donative intent.” In this case, it appears that the loan “was intended to be established at arm’s length,” the footnote said.