Get Out of Jail--But Not Free: Courts Scramble to Fill Their Coffers by Billing Ex-Cons

After serving time for robbery, Sharon Dietrich’s client Ameen Muqtadir was released from a Pennsylvania prison in 2002. Nine years later, he was ensnared in a sweep launched by the Philadelphia court system to collect up to $1.5 billion in unpaid criminal files and costs. Photo by Bill Cramer.

In Monopoly, a roll of the dice can get you a chance to draw a “get out of jail free” card to keep your piece moving around the board. But in the game of life, it takes real money to get out and stay out of real jails.

The lesson is not lost on Ameen Muqtadir. When he walked out of a Pennsylvania prison in 2002 after serving a stretch for robbery, he says, he was determined to put down the heroin and cocaine that he blames for keeping him behind bars on and off since his teens.

“I was able to walk away from the system entirely,” recalls Muqtadir, 54. Or so he thought.

Years after he returned to his hometown of Philadelphia, Muqtadir found the system hadn’t let him go. He learned the Philadelphia courts had him on the hook for nearly $41,000 in forfeited bail and costs for failure to appear in 1991 and again in 1997 in two earlier robbery cases.

The problem: Muqtadir couldn’t come to court because he was locked up in prison, and the underlying charges in the other cases had been dismissed in the meantime.

“There was never any notice,” says Muqtadir, who today works as program director for Art House, a re-entry service for ex-offenders. “No letters for money. Nothing ever happened.”

Muqtadir learned about the forfeitures when he was caught up in a sweep launched last year to collect up to $1.5 billion in unpaid criminal fines and costs, including $1 billion in bail the courts say is forfeited. The sweep covers an estimated 320,000 people—nearly a quarter of the city’s population. Some delinquent accounts date to the 1970s.

Since the 1990s, state and local governments across the nation increasingly have turned to fees imposed on criminal defendants to keep their justice systems afloat in economically tough times. Besides fines, deemed punishment, and restitution, which repays victims, states have imposed thousands of other revenue-raising schemes on offenders. Many have faint ties to crime and punishment or individual offenses, such as an attempt by a Massachusetts sheriff to increase charges for county jail inmates’ haircuts above the $1.50 limit set by state prisons.

Usually, though, much of the money is uncollectible. Ex-offenders typically move often, making it difficult if not impossible to serve them with delinquency notices or arrest warrants. Others, such as Muqtadir, hide in plain sight: in prison. But advocates say most are just too poor to pay.

Threats of more jail time for nonpayment also constantly loom. Some critics worry heavy-handed tactics used to collect from ex-offenders signal a return, in effect, to debtors’ prisons, which were abolished in the United States in the 1830s.

“I’ve never been in a courtroom where people are so angry as when it’s one of our cases,” says Muqtadir’s lawyer, Sharon M. Dietrich of Philadelphia’s Community Legal Services, which provides free representation to poor people.

Though she’s an employment lawyer, Dietrich says she’s amazed she spends so much time lately in criminal court.

“I even had one guy with paperwork from the ’90s that said ‘final payment’ and was signed by a court officer,” Dietrich says. “I’ve seen grandmothers paying for their grandsons, thinking [they themselves are] going to jail.”

Another of Dietrich’s clients, Hakim Waliyyudin, has bail problems too. After Waliyyudin was arrested on two domestic violence charges in late 2010, his bail was set at $10,000. Philadelphia has no private bail-bond services, so Waliyyudin had to post a $1,000 bond with the court to secure his release. He languished in jail for 12 days until he raised the money.

The charges ultimately were dropped, so the 35-year-old truck driver trotted down to court to get his money back. He understood he was going to have to pony up perhaps a 10 percent fee the courts planned to take from the $1,000. It turned out that wasn’t all because Waliyyudin had missed a court date.

“That’s the strange part about it,” Waliyyudin recalls. First, the clerk nonchalantly told him the courts weren’t going to be content just to keep his measly $1,000. “Then the lady told me I owed about nine grand. I didn’t understand that. They’ve added a collection fee of $750 for each count. That’s another $1,500. They basically just took my money.”

Pamela P. Dembe, chief common pleas judge, initially said showing up in court is a condition of bail, which put officials on solid ground. Dembe is one of the prime architects of the collection effort. Waliyyudin’s court file, however, didn’t show the required bail forfeiture order or notice. A hearing officer cited that lack of notice in late March and recommended a waiver of the $9,000 in judgments and the $1,500 in collection charges against Waliyyudin, meaning he also should get his bail deposit back after a judge signs off on it, considered a formality. In December, Dietrich had also persuaded Dembe to vacate Muqtadir’s bail judgments.

“We win most cases,” Dietrich says.

INDIGENT SQUEEZE PLAY

The U.S. Supreme Court has unambiguously held that criminal defendants can’t be jailed for inability to pay through no fault of their own. But state courts across the country routinely ignore that command and send people to jail without the required hearing to determine whether a defendant is indigent. They can steer around that by sentencing defendants for failure to appear in court, instead of nonpayment, though jail often means a reduction in a defendant’s tab calculated against time served.

Moreover, defendants facing civil contempt—the usual vehicle in nonpayment cases—must do so without a lawyer in many states, as the right to counsel applies only in criminal matters. The Supreme Court drove the point home in 2011 when it ruled that South Carolina didn’t have to provide a young father with a lawyer in a civil contempt proceeding for nonpayment of child support.

People who are able to pay but refuse get neither breaks nor sympathy.

Though the amounts of money states want can appear nominal to most, say $30 to $50 a month, they can total hundreds and even thousands of dollars over a lifetime and can mean fortunes to folks already living on the margins. Nonpayment of court fees in some states can mean loss of one’s driver’s license or denial of public benefits, such as housing assistance. Or it can inflict damage on credit reports so severe that employers and landlords who use them as background checks may think twice about hiring or renting to an ex-offender.

“We are trying to teach people to live in the straight world, which takes a different set of skills than living in prison or living on the edge,” says lawyer JoAnne Page, CEO for the Fortune Society, a nonprofit New York City re-entry program. Services include basic financial planning, as well as dealing with judgments that appear on credit reports.

For some, child support obligations collide head-on with court costs and fees. Since missing a support payment means an almost sure ticket back to jail, offenders often take chances by skipping court-imposed assessments.

Still, critics complain that it costs more to lock someone up than states can reasonably hope to collect.

States often have low thresholds for measuring success. In Florida, for example, the state expects clerks to collect 9 percent of the assessments on felony defendants, though the percentages increase appreciably with misdemeanors and traffic offenses, where the fines and costs are considerably lower than those levied on felons. Civil courts throughout Florida have nearly 100 percent compliance across the board.

So Leon County Circuit Court Clerk Bob Inzer in Tallahassee says he’s doing swell with a 14 percent felony collection rate.

“They’re not making a lot of money while they’re in jail,” Inzer says. “What are you going to threaten them with? Nonpayment? Suspend their driver’s license? They’re not going anywhere.”

In November 2010 Chief Circuit Judge Charles A. Francis canceled 8,293 “blue writs,” arrest warrants issued for people who don’t appear in court to explain why they can’t pay. The underlying assessments, however, remained in force, in case the subject is unfortunate enough to wind up, once again, in court.

Instead of threatening people with arrest, Leon County hopes to squeeze payments out of the debtors it can find with 90-day mailed delinquency notices.

Despite the clerk’s professed misgivings, Inzer’s office also asks the state highway safety department to suspend debtors’ driver’s licenses, a penalty criticized as particularly harsh because in many areas it takes a car to get to work. Driving on a suspended license, of course, constitutes a new crime and trip to jail in itself.

Those who still don’t comply may face calls and visits from private bill collectors, who can tack up to 40 percent onto the original amount. Like consumers futilely trying to stay ahead on credit cards by making minimum payments, many former offenders wind up staring down a never-ending tunnel of debt that often narrows to a one-way road back to prison.

Francis says he and other judges aren’t exactly doing flips over legislators’ attempts to support the state justice system by telling clerks how to run their offices without giving them the proper tools.

“The clerks need the authority to negotiate a settlement on these collections,” Francis says. “They can’t do a thing.”

Afi Turner, career adviser for the Fortune Society, was paroled in 2009 after serving nearly 20 years for the shooting death of her cousin. She pays a low assessment, $15 a month, for parole supervision, but it still can force her to choose between a co-pay at the doctor’s office or a few groceries. Turner says it’s like being forced to pay for her freedom. Photo by Len Irish.

CASTING A WIDE NET OF ASSESSMENTS

Though every state is different, lawyers involved in fee cases say lower-level courts and courts in small jurisdictions often are the most aggressive collectors. Smaller jurisdictions often count on criminal fees as indispensable revenue sources, while collections receive little or no priority from urban courts and law enforcement. Philadelphia represents a major exception.

Many types of fees raise little debate, such as prisoner room and board, and investigative, prosecution and even defense costs, though criminal defendants are guaranteed the right to free counsel. Eyebrows start to arch, however, when states stray from the criminal justice path. Sometimes assessments reach beyond offenders and hit their families.

“Ohio currently has 46 ways to lose your driver’s license, and 17 of them don’t have anything to do with driving,” says Tim Young, the statewide public defender who presides over a mosaic of court systems and local customs in the Buckeye State’s 88 counties.

States force criminals to contribute to funds for head-injury victims. Defendants charged with “victimless crimes” have been made to contribute to victim compensation programs. Courthouse construction is another favorite, as are programs for firearms education and highway safety.

Get arrested on a warrant in Texas? That will be $50, please. Those arrested without warrants only pay $5. Going to jail in Texas? Bring money, because it costs $5 to get in and another $5 to get out. Get convicted of a felony in New York? That means a mysterious $300 “surcharge” on top of everything else. Want parole in Pennsylvania? It costs $60 or parole is denied.

Want visitors in an Arizona prison? Each adult visitor must pay $25 for a background check. Is your kid locked up? In Delta County, Mich., Edwina Nowlin—homeless at the time—went to jail in 2009 for failing to pay $104 a month to keep her 16-year-old son in a juvenile detention hall. She was released for a day to pick up a $178.53 paycheck from part-time work, which the sheriff promptly forced her to sign over to cover her room and board.

States have tried still more creative ways to squeeze money from offenders.

Tennessee lawmakers want to forbid them from filing civil litigation until state debts are paid. Several states and the ABA have endorsed federal legislation that would allow the Internal Revenue Service to intercept income tax refunds.

And many jurisdictions unabashedly divert money away from courts’ needs.

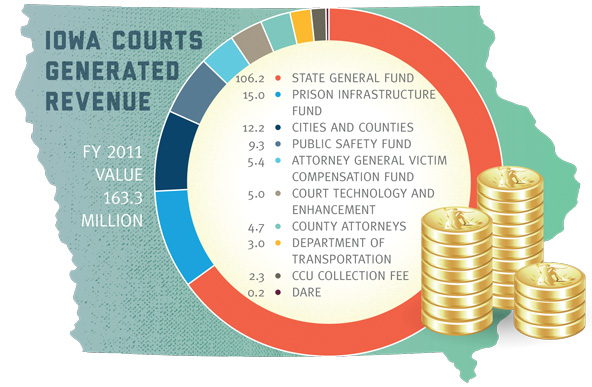

Though supporting a justice system through fines and fees is a dubious proposition at best, Iowa courts actually could meet their $156.5 million 2012 budget for court operations and jury and witness expenses from the money they reel in. But while Iowa courts collected $163.3 million in the 2011 budget year, the state took $106 million for its general fund and the bulk of the remainder was dedicated to other government entities, such as cities, counties and the state transportation department.

The estimated $2 million Philadelphia has collected so far goes into the city’s general fund, where it can be used for anything. The city has written off another $1 million as uncollectible. “It’s an evolving area where courts are starting to operate like businesses,” says Judge Dembe.

Still other states have attempted to soften the law’s approach to ex-offenders. Last year, Maryland became the fifth state to ban most employers from using credit checks to deny jobs based on irrelevant information the reports may contain, such as unpaid court judgments for fines, fees and costs.

Among other tactics, some jurisdictions in Washington state relied on scofflaws to turn themselves in until the state supreme court halted the practice. Washington legislators took another step in 2011 with a measure to allow inmates to petition to eliminate or reduce the 12 percent interest on most fines and fees that accrue during incarceration. They acted after hearing horror stories such as the tale of one inmate who entered prison with a $35,000 debt that ballooned to more than $100,000 by the time he was released.

Yet the fee meter keeps running in many states, unnoticed or taken for granted, even by defense lawyers, whose first goal is to keep clients out of prison on the underlying substantive charges.

“I feel fairly ashamed that I let it go on for so long,” says Ohio defender Young. As a result many folks, like Philadelphia defendant Muqtadir, walk out of prison blissfully unaware of the debts that follow them.

“Over and over, I hear the same story: ‘I just didn’t know I had this debt,’ ” says lawyer Mitali Nagrecha, senior policy adviser at the Fortune Society in Long Island City, N.Y. Nagrecha co-authored a major report on criminal justice debt (PDF), released in October 2010 by the Brennan Center for Justice at New York University School of Law. It accompanied a similar comprehensive study by the American Civil Liberties Union, which also represents some debtors in court.

“In the wake of that frustration, people just throw their hands up,” Nagrecha says.

Graphics by Holly Tempka

THE COST OF FREEDOM

Afi Turner understands. She sees it every day in her job at the Fortune Society, where she acts as a kind of headhunter for released inmates needing jobs. “You get a little bit of everything.”

Before she was paroled in 2009, Turner, 39, served nearly 20 years in a New York prison for shooting and killing one of her cousins and wounding another. Though Turner’s assessment is low, $15 a month for parole supervision, she says it sometimes can force her to choose between a co-pay at the doctor’s office or a few groceries. She says it’s like she’s being forced to pay for her freedom.

“For myself, and for anybody coming home, it’s just not realistic,” Turner says. “Like myself, most people are just trying to get it together.”

To boot, outstanding fines, fees and costs can make it that much more difficult for released inmates to readjust to life on the outside.

“The clients are just like myself,” Turner says. “They have the same questions I do.”

One of those is David Ortiz, 53, who came home in 2010 after serving 32 years for murdering a man during a robbery.

He pays $30 a month for parole supervision, which could last for the rest of his life because he was convicted of murder. Ortiz was able to find work fairly quickly with a medical equipment company in New Jersey, but he had to turn the job down.

“My parole officer didn’t want me driving over the George Washington Bridge to Jersey,” he says. “So it took me a year to find a job.” The company eventually found Ortiz a part-time position in New York. But he still can’t pay his rent and has to rely on the Fortune Society for assistance.

“Imagine being released after 32 years,” he says. “It’s like a different planet. You don’t know which way to turn.”

Philadelphia court officials aren’t flinching, though. Their collection attempts are perhaps the most ambitious anywhere. And they say anyone who truly can’t pay shouldn’t fear jail.

“We don’t have enough jail cells to do that,” Judge Dembe says. Philadelphia also handles its collections as criminal contempt, so a constitutionally promised lawyer is no issue, as it is in states that go the civil route.

The crackdown began after a 2009 Philadelphia Inquirer series detailed a court system in disarray. Court officials don’t dispute that, but Dembe says the problems really began decades ago in the 300-year-old office of the elected clerk of quarter sessions, responsible for maintaining court records and collecting bail money and fines in criminal cases. The city abolished it in 2010, and the judges took over.

The former office failed to collect 90 percent of the bail judges ordered forfeited, according to a July 2011 state supreme court progress report on the new efforts.

“They were as dysfunctional as you could possibly imagine,” Dembe says. “Every accounting function you are supposed to do, they weren’t doing.”

The court first mails notices to delinquent account holders. Those who don’t respond may next receive a visit from a lawyer from one of the four firms the city has hired as collection agents. More than 600 city employees, who owe the courts an estimated $1 million, can kiss goodbye to as much as 20 percent of their biweekly paychecks until their debts are satisfied.

To be sure, officials have tried to make it easier. Before the collections kicked off in March last year, they ran television, radio and print public service announcements warning people what was ahead. They have also taken steps to clear the angry courtrooms defense lawyer Dietrich describes by allowing ex-offenders to file online petitions for bail forfeiture waivers. Those without computers can use one at the clerk’s office or public libraries.

Though she’s pleased by the new, streamlined procedures, Dietrich wonders whether a program that barely pricks the surface of the $1.5 billion the courts say they’re owed is as much about instilling respect for the justice system.

“They wanted to change behavior so people won’t miss their court dates,” she says. “They’re pretty unabashed.”

Dembe has no problem there.

“Deep in our little hearts, we knew we could never collect that much,” she acknowledges. “But it was a goal to shoot for. And shoot for it we did.”